rhode island state tax rate 2020

State of Rhode Island Department of Labor and Training Submit. The states sales tax rate is 7 and there are no local sales taxes to raise that.

Rhode Island 30 Towns To Decide On Marijuana Sales Measures This November Norml

This page has the latest Rhode.

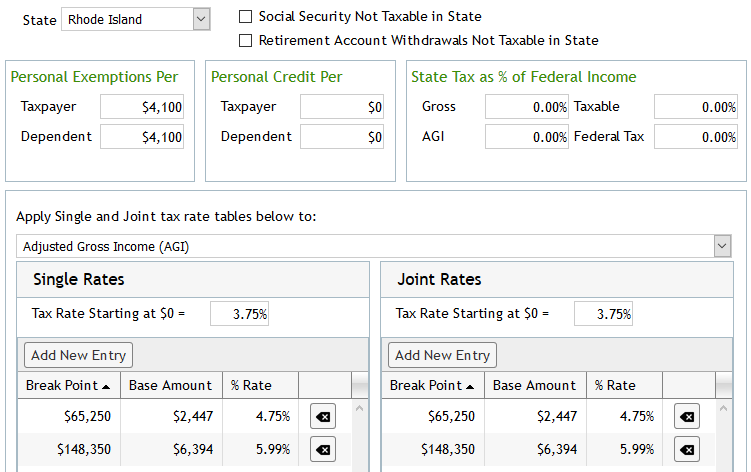

. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Detailed Rhode Island state income tax rates and brackets are available on. Tax rate of 475 on taxable income between 68201 and 155050.

The income tax is progressive tax with rates ranging from 375 up to. Find your income exemptions. 3 rows Rhode Islands 2022 income tax ranges from 375 to 599.

Rhode Island Tax Brackets Rates explained. Information on how to only file a Rhode Island State Income Return. 2022 Rhode Island state sales tax.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. Rhode Island Tax Brackets for.

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. The state of Rhode Island does have an individual income tax. 1300 per thousand of the assessed property value.

Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Detailed Rhode Island state income tax rates and brackets are available on. Follow us on Facebook.

Contributions collected from Rhode Island employers under this tax are used. Tax rate of 599 on taxable income over 155050. The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Interest on overpayments for the calendar year 2020 shall be at the rate of five percent 500 per annum. State Income Taxes in Rhode Island.

Exact tax amount may vary for different items. The rate so set will be in effect for the calendar year 2020. For married taxpayers living and working in the state.

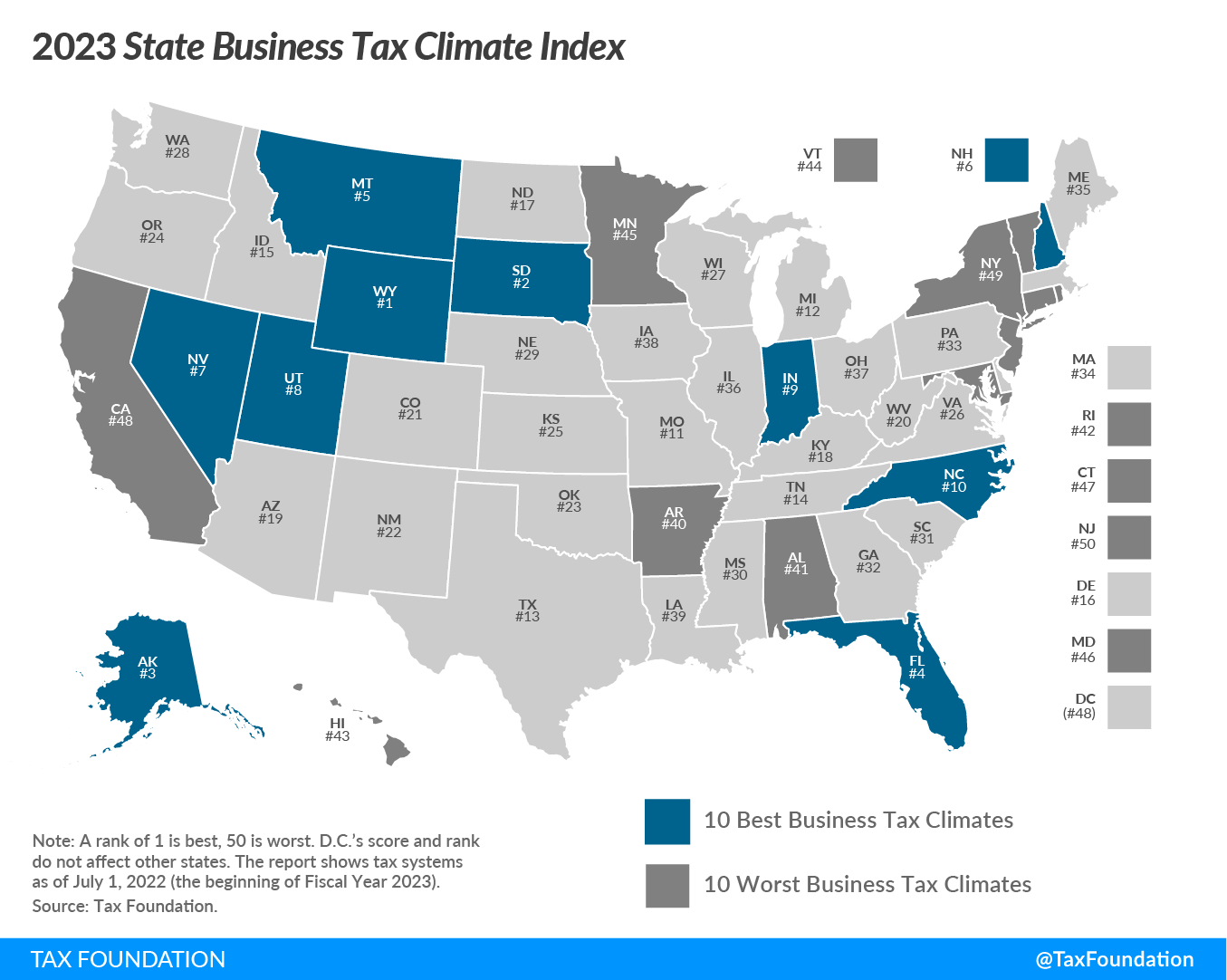

Like most states with income tax it is calculated on a marginal scale. The average effective property tax rate in Rhode Island is 153 the 10th-highest in the country. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate Index.

State of Rhode Island Division of Municipal Finance Department of Revenue. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Find your pretax deductions including 401K flexible account.

About Toggle child menu. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

The Rhode Island Division of Taxation has released the state income tax. This means that these brackets applied to all income earned in 2019 and the tax return that. Current and past tax year RI Tax Brackets.

State Income Taxes Updates For 2020 Moneytree Software

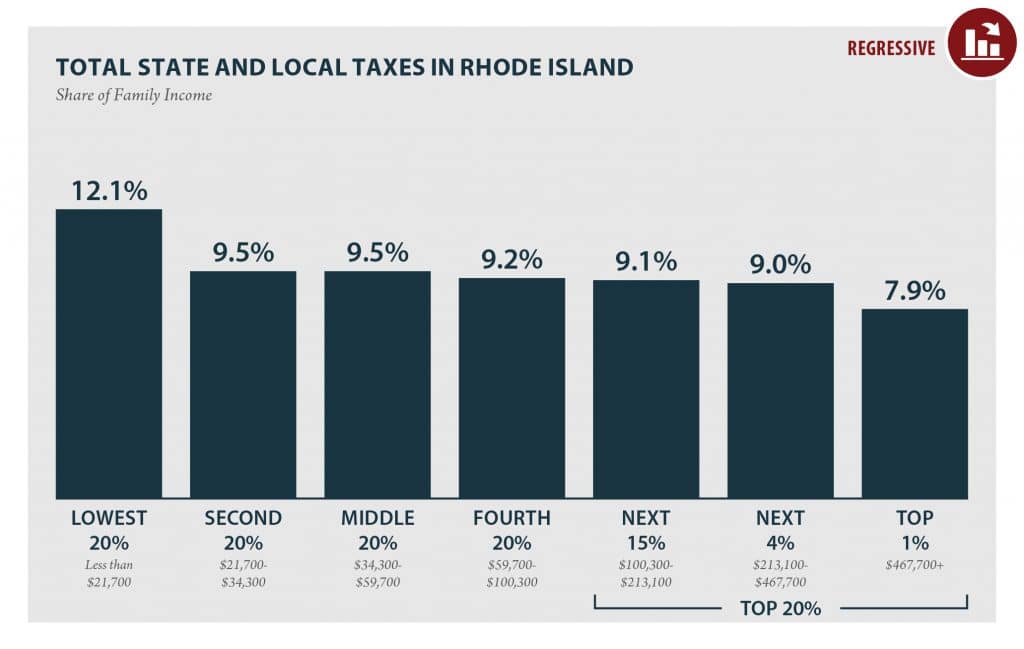

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Ripec Bryant University S Center For Global And Regional Economic Studies Release New Key Performance Indicators Quarterly Briefing Rhode Island Public Expenditure Council

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Calculator Smartasset

Rhode Island State Data And Comparisons Data Z

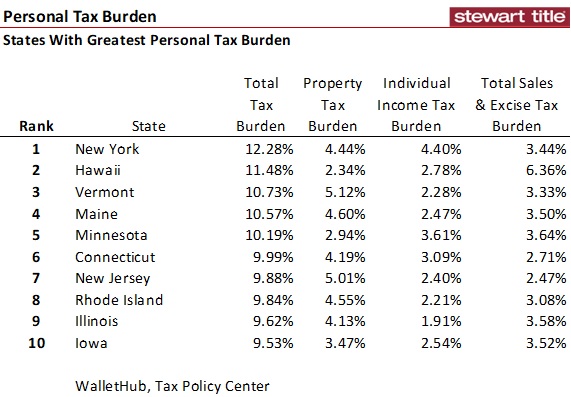

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

States That Tax Social Security Benefits Tax Foundation

Ri Retail Sales Permit Renewal Fill Out And Sign Printable Pdf Template Signnow

Get And Sign Rhode Island Form 1041 Schedule W Fiduciary Schedule W 2020 2022

How Do State And Local Sales Taxes Work Tax Policy Center

Rhode Island State Tax Information Support

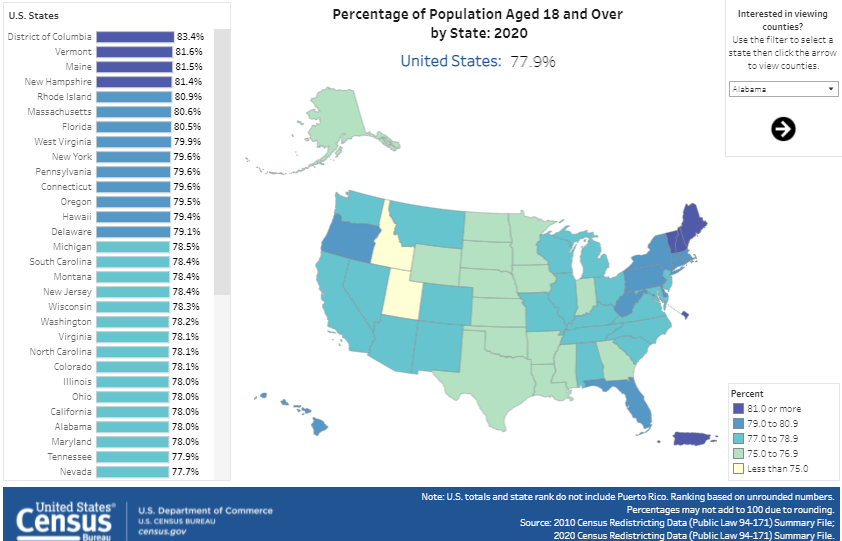

R I Latino Population Grew By Nearly 40 Percent In The Past Decade Census Shows The Boston Globe

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Massachusetts Rhode Island Natp Chapter January 2020

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

Rhode Island Income Tax Ri State Tax Calculator Community Tax